Latin America

Macroeconomics updates

Brazil: Brazil's M&A landscape in 2025 faces uncertainty due to high interest rates, inflation, and political instability, leading to reduced deal activity. Investors, both domestic and international, are exercising caution in response to these economic challenges. Despite this, sectors such as energy and infrastructure are expected to play a key role in driving future transactions. The evolving economic environment will significantly influence the M&A outlook in the country. Source: BNamericas

Mexico: The Mexican Peso has dropped significantly, with the USD/MXN exchange rate increasing by over 1.40%. This decline is mainly driven by expectations that Banxico will cut interest rates at its September 26 meeting, potentially by 25 basis points, bringing the rate to 10.50%. The cooling inflation data in early September supports this potential rate cut. Analysts believe that if Banxico proceeds, the Peso could weaken further, with the exchange rate possibly reaching 20.00. Source

Financial Technology News

Brazil: Parabank has introduced new credit solutions in Brazil, specifically designed for individuals with disabilities. These offerings aim to enhance financial inclusion by addressing the barriers faced by this underserved demographic in accessing credit. The initiative represents a broader effort within fintech to create more inclusive financial products that cater to diverse community needs, helping improve financial autonomy for people with disabilities. Source: Fintech Global

Argentina: Argentina's top three digital banks—Ualá, Brubank, and Naranja X—hold nearly 90% of the market share, serving 16.44 million customers. These banks have grown significantly by offering user-friendly platforms, financial inclusion, and innovative services. Ualá leads with 6 million customers, followed by Brubank with 5.81 million, and Naranja X with 4.63 million. This growth is driven by strategic product offerings and a focus on meeting the evolving needs of consumers. Source

Fintech Fundraising News

Equity Raises:

Brazil: Mercado Pago raised $181 million through Brazilian debt issuance to fuel its expansion efforts. The funds will be used to bolster its presence in Latin America, particularly Brazil, where the company aims to enhance its financial services offerings. This debt issuance aligns with Mercado Pago's broader strategy to grow its digital payments infrastructure and services in one of its key markets. Source

Mexico: Mexican insurtech Koltin has successfully raised $7.3 million in a Series A funding round. The funds will be used to expand its product offerings and boost its market presence. Koltin focuses on simplifying the insurance experience for consumers by providing digital solutions that make accessing and managing policies easier. The funding highlights continued investor confidence in the growing insurtech space in Latin America. Source

Asia

Macroeconomics updates:

China: China's recent monetary interventions, such as rate cuts and liquidity injections, have struggled to address the core threats to its economic growth, particularly the slowdown in consumer demand and private investment. Despite these measures, deeper structural issues in the property sector and weakening global demand continue to hinder recovery. Analysts suggest that without significant reforms or fiscal stimulus, China's growth trajectory may remain under pressure. Source

India: The world is optimistic about India's economy due to its strong growth projections, driven by factors like robust domestic demand, a young workforce, and digitalization efforts. India's resilience amid global economic uncertainty and reforms aimed at enhancing infrastructure and manufacturing have further boosted confidence. Additionally, India's geopolitical stability and proactive policy measures are attracting global investors, positioning it as a key player in the global economic landscape. Source

Financial Technology News

India: Fintech Jupiter is reportedly in talks to acquire a stake in SBM Bank India. The potential deal is part of Jupiter's broader strategy to strengthen its position in the Indian financial services market. SBM Bank India, known for its focus on digital banking services, would provide Jupiter with greater access to banking infrastructure and resources, aligning with its plans to expand its offerings. Source

China: Hong Kong has regained its place as one of the world's top three financial centers, climbing to first in the Asia-Pacific region, according to the Global Financial Centers Index. The city's resilience is backed by its strong ties to the Chinese mainland and financial reforms. Despite challenges like the COVID-19 pandemic and geopolitical tensions, Hong Kong continues to thrive, particularly in investment management and fintech, bolstered by supportive government policies and innovation in sectors like green finance. Source

Fintech Fundraising News

Equity Raises:

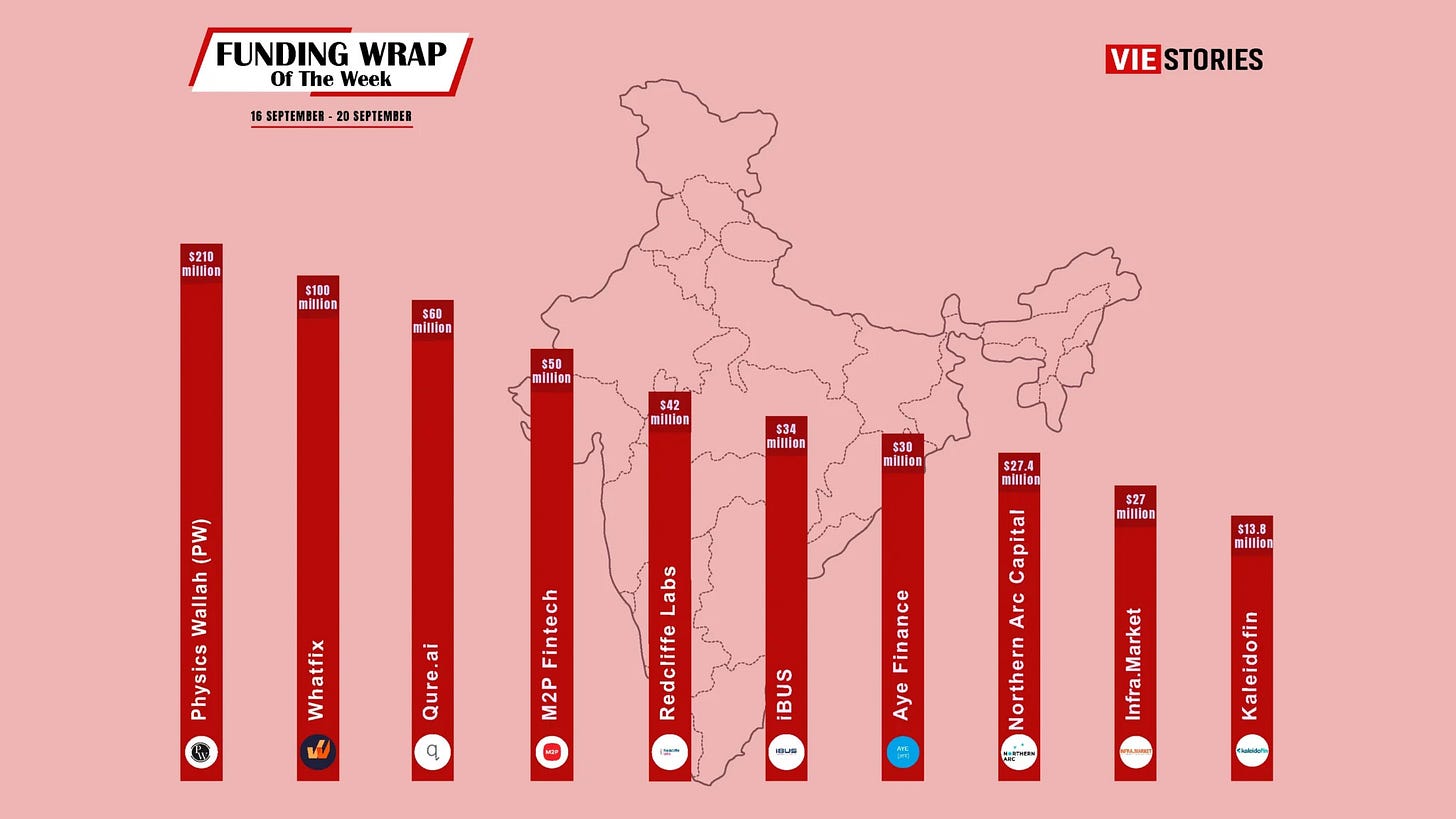

India: India’s M2P Fintech is reportedly close to securing an $80 million funding round. This financing is expected to further the company's growth in the digital payments and financial infrastructure space, helping it expand its market presence and scale its operations. M2P has been a key player in developing API-based solutions for various financial services, including lending and banking, making this funding crucial for its future endeavors. Source

India: India's tech funding has dropped to $7.6 billion in 2024, marking a 66% decline over the past two years. This steep decrease highlights the challenges faced by the tech sector, as global economic conditions and reduced investor confidence have impacted startups' ability to raise capital. Despite this, some sectors within the tech industry, such as fintech, continue to attract investor interest, although at a slower pace. Source

Africa

Macroeconomics updates

South Africa: South Africa is aiming to reform its Black Economic Empowerment (BEE) system, which has struggled to address inequality. The government seeks to revamp the policy to better support black-owned businesses and address the growing dissatisfaction around wealth disparity. The current system, introduced post-apartheid to boost black ownership and participation in the economy, has been criticized for benefiting only a small elite while failing to uplift the broader population. Source

Nigeria: The Central Bank of Nigeria (CBN) has raised the Monetary Policy Rate (MPR) to 27.25%, continuing its monetary tightening strategy to curb inflation. This increase comes as part of ongoing efforts to stabilize the economy amid inflationary pressures. The decision highlights the CBN's commitment to controlling rising prices and maintaining economic stability through interest rate adjustments. Source

Financial Technology News

Nigeria: Nigeria Fintech Week 2024 will focus on the potential of generative AI and the importance of smart regulation in the fintech industry. The event aims to explore how AI can transform financial services while ensuring that regulations keep pace with innovation. Participants will include industry leaders, regulators, and tech innovators discussing how to balance technological advancements with responsible governance to foster growth in Nigeria's fintech ecosystem. Source

Kenya: Fintech giant M-KOPA has reached a milestone of 5 million customers across Africa, including in Kenya. The company, known for its innovative pay-as-you-go financing model, provides products such as smartphones, solar power, and electric motorbikes to underserved communities. This achievement highlights M-KOPA's impact on increasing financial inclusion and providing affordable access to essential goods for millions of people across the continent. Source

Fintech Fundraising News

Equity Raises

Nigeria: Nigerian digital ID startup RegFyl has raised $1.1 million to help address Africa's anti-money laundering (AML) compliance challenges. The company focuses on providing digital identification and verification services that streamline regulatory processes for businesses, especially in the financial sector. With this funding, RegFyl aims to expand its services across Africa, supporting institutions in meeting compliance requirements and reducing financial crime risks. Source

Nigeria: The Nyala Facility, backed by the FSD Africa Investments (FSDAi), has provided a $1 million boost to African fintech firms. This funding aims to support rising fintech companies by offering them the necessary capital to scale their operations and enhance financial inclusion across the continent. The initiative underscores the growing importance of fintech in addressing financial accessibility challenges in Africa, especially for underserved populations. Source

South Africa: Happy Pay, a South African fintech company, has raised $1.8 million to reduce consumer credit costs to zero. The startup aims to offer innovative credit solutions that eliminate fees for borrowers, making credit more accessible and affordable. The raised funds will be used to scale its operations, enhance technology, and broaden its reach across the market. This initiative reflects the growing trend of fintech firms working to provide more inclusive financial services in Africa. Source

Middle East

Macroeconomics updates

Dubai: Dubai is experiencing a significant boom in its hedge fund sector, contributing to the UAE's economic diversification. The Dubai International Financial Centre (DIFC) saw a 125% year-on-year growth in hedge fund activity, with major international capital flowing into key sectors such as real estate, technology, and infrastructure. This surge supports Dubai’s ambition to become a global financial hub, aligning with the Dubai Economic Agenda (D33). Hedge funds are also playing a crucial role in job creation and financial innovation in the region. Source

UAE: The UAE Central Bank has raised its GDP growth forecast for 2024 to 4%, driven by strong performance in the non-oil sector. This revision is attributed to robust economic activity in areas like tourism, real estate, and manufacturing. The non-oil sector is expected to grow by 4.5%, highlighting the UAE's economic diversification efforts. The oil sector, meanwhile, is projected to grow by 3%, supported by stable production levels. This upward revision reflects the UAE's ongoing focus on sustainable, broad-based growth. Source

Financial Technology News

UAE: Astra Tech's subsidiary, Quantix Technology Projects, has received a license from the UAE Central Bank to offer various financing services to UAE residents. These services include personal loans, auto loans, and Buy Now, Pay Later (BNPL) options. This is the first such license granted since 2016. The company aims to enhance access to micro-financing and support economic growth. Quantix joins Astra Tech's portfolio, which includes PayBy and Botim, expanding their fintech services in the UAE. Source

Egypt: Egypt's Ministry of Finance has partnered with eFinance to digitize the payment process for building violations fees. This initiative aims to streamline and modernize the collection of fees, enhancing transparency and efficiency. By offering a digital platform for payments, the partnership seeks to make the process more accessible to citizens and reduce reliance on cash transactions, aligning with broader national goals of advancing Egypt’s digital economy. Source

Fintech Fundraising News

Equity Raises

Egypt: Egyptian fintech startup Settle has secured $2 million in pre-seed funding to accelerate its growth. The company aims to revolutionize B2B payments by providing digital solutions for seamless financial transactions between businesses. This funding will help Settle enhance its platform, expand its team, and improve its service offerings to support small and medium-sized enterprises (SMEs) in Egypt's growing digital economy. Source

Egypt: Egyptian fintech Paymob has secured an additional $22 million in a Series B extension round, led by the European Bank for Reconstruction and Development (EBRD) Venture Capital. This funding will support the company's expansion plans, enabling it to enhance its digital payments infrastructure and accelerate growth across the Middle East and North Africa (MENA) region. The round brings Paymob closer to its goal of driving financial inclusion through innovative digital payment solutions. Source